Trade finance with ESG

Increasingly, trade finance and supply chain finance should link to compliance with ESG standards in supply chains – which we natively support across our platform.

- Please see more about ESG: here.

- Please see more about our real-time ESG technology: here.

- Please see more about our worker voice app: here.

Why should trade finance link with ESG?

Around the world, regulators, shareholders, savers and politicians are implementing policies and standards the link the availability and cost of money to delivery on ESG standards. This means trade finance should link to ESG compliance.

- Climate change and its consequences have reached global awareness – and an increasing number of businesses have announced environmental commitments, including to achieving a “net zero” carbon footprint.

- The internet and cheap travel has also made the world a smaller place – bringing issues around poverty, worker treatment, forced labour, fair pay, child labour directly into focus. This is partly because we can now travel more easily to locations where products are made, and partly because it is much easier to find out about what is happening because of real-time communications, person-to-person.

And the key stakeholders in the financial system have been looking for levers that can be applied to deliver change. The cost and availability of money is one of a number of tools being developed and deployed to drive change.

This report indicates how important it is for banks to be engaging with ESG – see the BankTrack report indicating that 4 out of 5 banks are “failing on human rights” here.

Institutional ESG versus enterprise ESG and trade finance

It is important to keep a clear head when thinking about ESG. There are two data / technology problems to be solved:

- How do enterprises measure their ESG performance?

- How do financial instutions make sense of the increasingly vast amount of data available across all the enterprises that are out there?

Once these are considered, trade finance can link to ESG. But these are separate tasks.

The first task (enterprise-level) is to assemble data about the enterprise itself. This includes:

- Evaluating the standards and policies that the enterprise has set for itself and for its supply chain.

- How well those standards and policies are being implemented in practice?

- Coming up with a measure of the performance for each workplace and for each process involved, and then aggregating these to come up with a result for the enterprise as a whole.

The second task (market-level) is to consider all the different datasets and opinions published by enterprises to come up with an investing or lending framework. Something that allows comparison and standardisation across geographies, industries and enterprises – so that the better performers are rewarded and the weaker performers are incentivised to do better.

The importance of standardisation

This is at the heart of the matter. Without standardisation, how can we spot the better performers?

Relative or absolute improvements?

Moreover, enterprises have different scales of challenge. A coal mine has an enormous task to convince anyone that their business operations can meet current expectations around ESG, particularly on the environmental side. Somehow this also needs to be reflected in any ESG / lending / investing framework.

And this brings up another key question – surely we should accept that different enterprises in different industries will have different ESG outcomes – so we should focus on achieving relative improvements rather than trying to impose absolute standards.

So this means that not only do we seek comparable and standardised measures of performance, we should also track change over time. Perhaps we should measure and reward improvements more than simply removing entire industries from contemplation.

Why link trade finance or SCF specifically with ESG?

With trade finance and supply chain finance, banks / lenders generally have a slightly easier task. The good news about trade finance and supply chain finance is that the funding operates at the level of a single supply. We do not necessarily need to consider the performane of the enterprise as a whole – we can identify individual supply chains (ie: supplier to buyer relationships) and reward the supply chains that perform better and not finance or finance more expensively the supply chains where performance improvement is not happening quick enough.

So trade finance and supply chain finance are ideal candidates for linking to ESG – what is needed is an ESG reporting / monitoring system that is integrated into the cost of finance – and where finance costs can be moved from week-to-week rather than year-to-year. In this way, incremental improvements can be rewarded immediately.

This is really important for enterprises

One of the main challenges for the enterprise is how to incentivise change in its supply chains. Without real-time data, and without a real-time finance lever – the only recourse most enterprises have is to withdraw business from suppliers that do not meet their standards.

But once a real-time reporting system is in place, and once this is linked to the cost of trade finance and supply chain finance – proper incentive levers are established and change can be driven week-by-week into the supply chain. This really works.

PrimaDollar: real-time ESG reporting

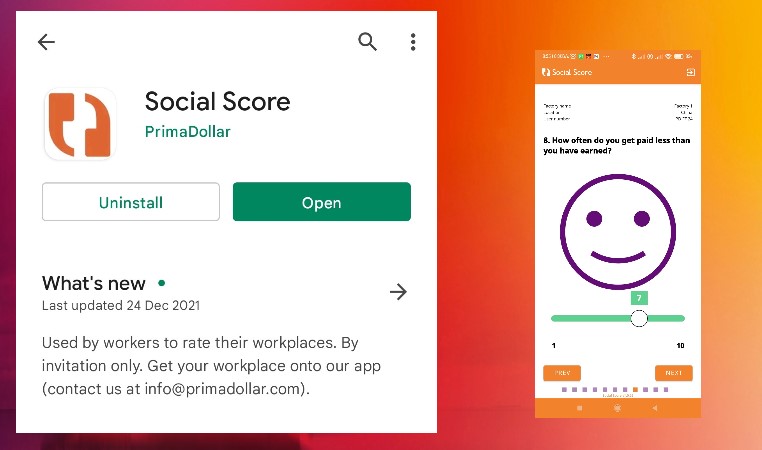

Our worker app deliver real-time monitoring and standardised reporting on social and governance issues in the supply chain. Read our one minute guide on the worker app here.

We are also a leading specialist in cross-border supply chain finance and trade finance and we link the social scores from our worker app directly into the cost of funding. This means that the cost of finance can vary by shipment depending upon the level of compliance of the workplace – in real-time.

How can I find out more?

With a global network and global coverage, talk to us.

and

Sign Up For Insights

Trade finance developments, announcements, new technology and new partners - find out about it by signing up here.

Apply here