ESG: Environmental, social and governance

ESG is not a new concept, the definition has been in use for many years. It is a fundamental part of the social contract between business and society and usually managed as part of “CSR” or Corporate Social Responsibility.

There are a few definitions of ESG circulating, and we prefer the one set out above: “Environmental”, “Social”, “Governance”. These three terms capture the three major axes of social responsibility that every corporate should be considering as they carry out their day-to-day business. Typically these three ESG concepts are translated into standards that are then applied across a business.

- Environmental covers a company’s energy and water use, waste, pollution, and treatment of animals. It also extends to its carbon footprint and the materials that are used in its products – and in how products might be recycled at their end of life. Related concepts include:

- “Net zero” – broadly ensuring that all its operations do not contribute to climate warming.

- “Scope 3” – which refers to the extended supply chain of a business, so ESG includes not just its direct activities but also those of its suppliers and suppliers of those suppliers etc.

- “Circular” – a key concept related to sustainability, meaning that the company’s activities and products are capable of being recycled so that the materials used go round in a circle to become new products and not dumped

- Social covers how company treats its workers and the society in which it operates – manifested through how the company conducts it business relationships and performs its under its social contract. This area includes how the company works with its supply chain, for example, how suppliers get paid. It also covers how workers are treated in its direct operations and in its supply chain: for example: are workers paid on time, are they forced to work, do they have adequate provision for holidays, breaks and time off, and how well are these policies implemented in practice? Other stakeholders are also important – for example, the local communities in which the business operates, and the wider pastoral needs of the families, customers and suppliers that are involved in helping the business to be successful.

- Governance relates to the principles by which a business operates. For example, are there equal opportunities for male and female staff, how does the company make decisions, how are conflicts of interest managed. are there proper procedures in place for whistelblowers and processes to minimise the risk of fraud, illegal payments or corrupt practices?

The UN sustainable development goals mapping to ESG

Another way to think about ESG is to put it in the context of the sustainable development goals that the United Nations published and adopted in September 2015 – commonly known as the “UN SDGs”.

There are 17 UN SDGs, and 13 of them map across to ESG.

The International Chamber of Commerce (ICC) has just completed a mapping exercise of the 17 UN SDGs in the context of trade finance – see here.

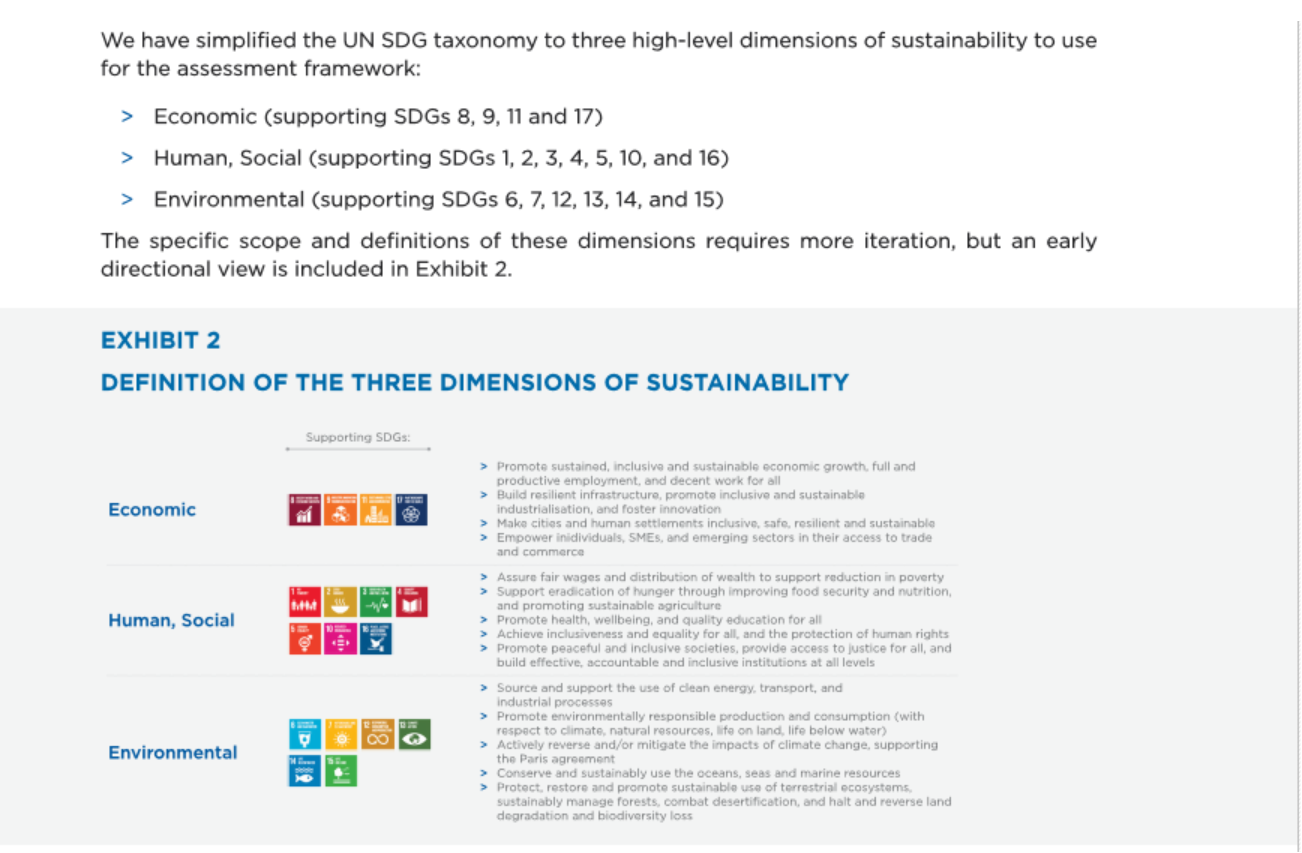

The below extract from their report shows the mapping that they have come up with. You can see here that “Human and Social” (meaning the “S” and the “G”) map to 7 of the SDGs, whilst Environmental “E” maps to 6 SDGs.

How do we measure “ESG”?

This is, perhaps, the most crucial question of all. If we cannot measure compliance with ESG, how can we hold companies to account? In fact, this is a very much a PrimaDollar point: measure it, manage it, improve it.

Measuring ESG compliance is difficult, especially if the goal is to be fully objective, impartial and to avoid “greenwashing”. Greenwashing is a term used when companies claim compliance with ESG standards but are actually not delivering. In our experience, very few businesses deliberately seek to obscure their performance – it is just that rigorous measurement of compliance with ESG standards is very difficult to achieve.

ESG version 1.0 measurement systems have been developed over the last 30 years and there are some very large and well-capitalised service providers operating on a global basis. Systems have developed over decades that are largely based on annual surveys and evidence-based self-certification. This provides base line data, perhaps once each year – allowing a foundation to be established and then change to be measured. The main issue with this model is that it is relatively easy to abuse – but on the other hand, it is the best that we have and the one that largely will continue as the bedrock for ESG compliance, control, and improvement going foward. And continued investment in process and systems around the concept of the annual review will improve these systems as every year goes by. Companies like Ecovadis, Bureau Veritas, Sustainalytics, Reprisk etc. are well-known global providers of services in this space.

A new breed of ESG measurement systems is emerging: ESG version 2.0 or “real-time ESG”. These are provided by technology-driven companies that aim to deliver ESG measurement at the level of the individual supply chain, a single workplace, even down to a single “SKU” 0r stock-keeping unit shipped to a business. Measurement at this level is only possible with technology – but starts to deliver a level of granularity that is much harder to greenwash and capable of real-time responsiveness. And with real-time responsiveness comes the ability to drive change incrementally all the time, rather than based upon annual snapshots.

To find our more about our worker app which measures social and governance compliance (the S + G of ESG) in real-time, click: here.

What is the future?

We all need to pay attention to ESG: measure it, manage it, improve it. And this goes across all of the UN SDGs that relate to environmental, social and governance issues. With the emergence of ESG version 2.0, we may well be able to start holding companies much more to account for their performance under the social contract. We have to continue investing in technology to achieve this – and PrimaDollar is leading the way.

As explained above, 7 of the UN SDGs relate to the “S” and “G” of ESG. Historically, using ESG version 1.0 systems, both “S” and “G” have been very hard to measure in any kind of systematic or fully independent way. PrimaDollar’s social score and worker app are changing this landscape on a global basis. And once ESG performance can be measured, it can be communicated to investors and consumers in business – and then the drive to improve will have real impetus behind it.

6 of the UN SDGs relate to environmental. This is a much more difficult area to measure universally because individual processes, workplaces, supply chains and products can have unique characteristics and unique environmental footprints. But there are major efforts going into standardisation – providing third party reference libraries that can be linked into business processes to deliver actionable data on carbon footprints and sustainability.

The ESG world is evolving rapidly across all three of the letters. We have to hope that these efforts continue and that we are all able to build to a much more transparent and socially-aware business framework.

How can I find out more?

With a global network and global coverage, talk to us.

and

Sign Up For Insights

Trade finance developments, announcements, new technology and new partners - find out about it by signing up here.

Apply here