News is breaking in Bangladesh of a US$90m fraud involving a government-owned bank (Janata) and a local exporter (Crescent Group).

Fraud risks have to be assessed and managed with great diligence and care. Making a poor credit decision can hurt, but fraud can be fatal to a bank, exporter or importer.

PrimaDollar is set up to help banks, exporters and importers to trade more safely at low cost and without collateral.

Of course, it would be imprudent to set out all the systems that we have in place – but here are some examples of fraud (or alleged frauds) from the last few years, and some guidance on how to use our services to help trade on better terms, whilst mitigating these risks.

Check the cost of our services: click here.

Should you be worried about these things?

Yes – these scams affect all of our wealth and prosperity, introduce uncertainty into business, and cause great harm to innocent people even if they are not involved. If you are caught up, the losses can be significant and even fatal to your business.

1. Janata Bank, Bangladesh – Crescent Group – alleged

News is breaking in Bangladesh (August 2018) of an alleged skimming fraud involving Tk 765 crore (about US$90m) of fraudulent export trades.

This situation seems very similar to the alleged Indian Modi fraud case (see next secton).

It is alleged that there was collusion between officials in Janata Bank (a state-owned bank) and Crescent Group companies to provide advance payments against export trades that never happened.

The process is alleged to be as follows:

Whether or not Crescent Group was complicit in the alleged processes, the reputational damage is significant.

2. Nirav Modi, India – Punjab National Bank – alleged

This is an alleged INR 6,498 crore (about US$950m) fraud involving the famous society figure and jeweler to the wealthy, Nirav Modi.

There are many similarities with the alleged Crescent Group fraud:

It has been alleged that:

3. Y&X, Bangladesh – 25 exporters affected

The Y&X story arose in the summer of 2017 – amounting to some TKs 600 cr (about US$70m).

This transaction did not involve corrupt officials in local banks, but shows how a lack of proper due diligence can lead to significant losses.

PrimaDollar has written an article about this topic already: click here.

4. How to avoid the fraudsters?

If you involve PrimaDollar in your transactions – whether you are bank, an importer or an exporter – you will benefit from our low cost finance, no requirement for collateral – and also from our systems and procedures to mitigate the risk of fraud in cross-border trade.

Your trades will be much safer with our involvement.

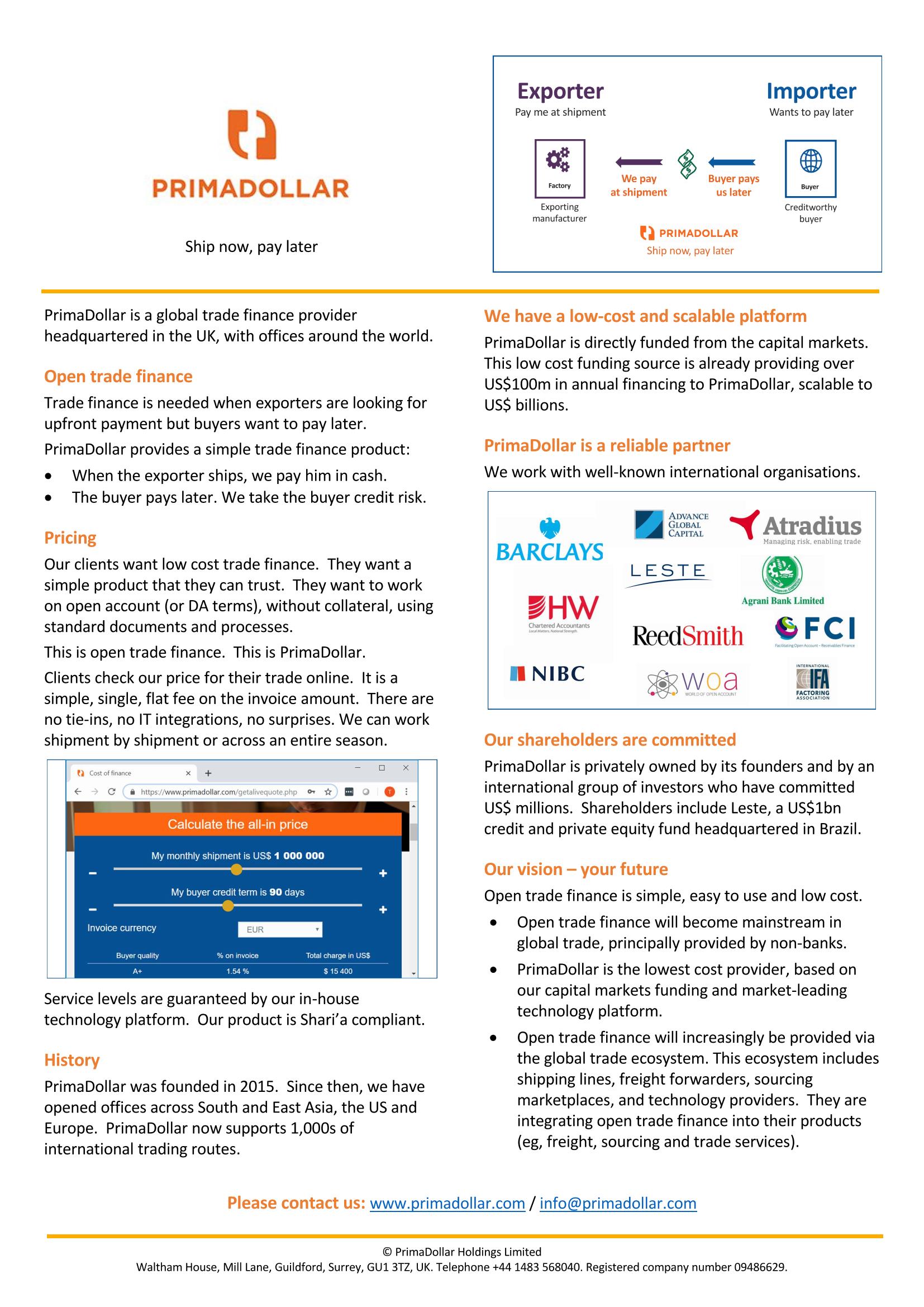

PrimaDollar provides low cost, collateral-free trade finance to exporters, buying houses, traders and importers. We sit in the middle of these supply chains.

We normally pay the exporter at shipment.

This means that we are exposed to the risk that a trade is fraudulent.

It could be that the exporter has no intention of making the goods, maybe the shipments do not exist, perhaps the importer is a fake company, perhaps the banks at either end of the supply chain are not providing correct information, maybe we are dealing with people impersonating the actual companies that we think we are dealing with etc.

Fraud risk is, perhaps, the biggest challenge that any trade financier has to deal with. We take these risks seriously. We have the systems and procedures in place to detect and avoid those transactions which are not right. Sometimes, perhaps, we get “false-positives” which means that we turn down probably good transactions. But this also is a necessary part of our business.

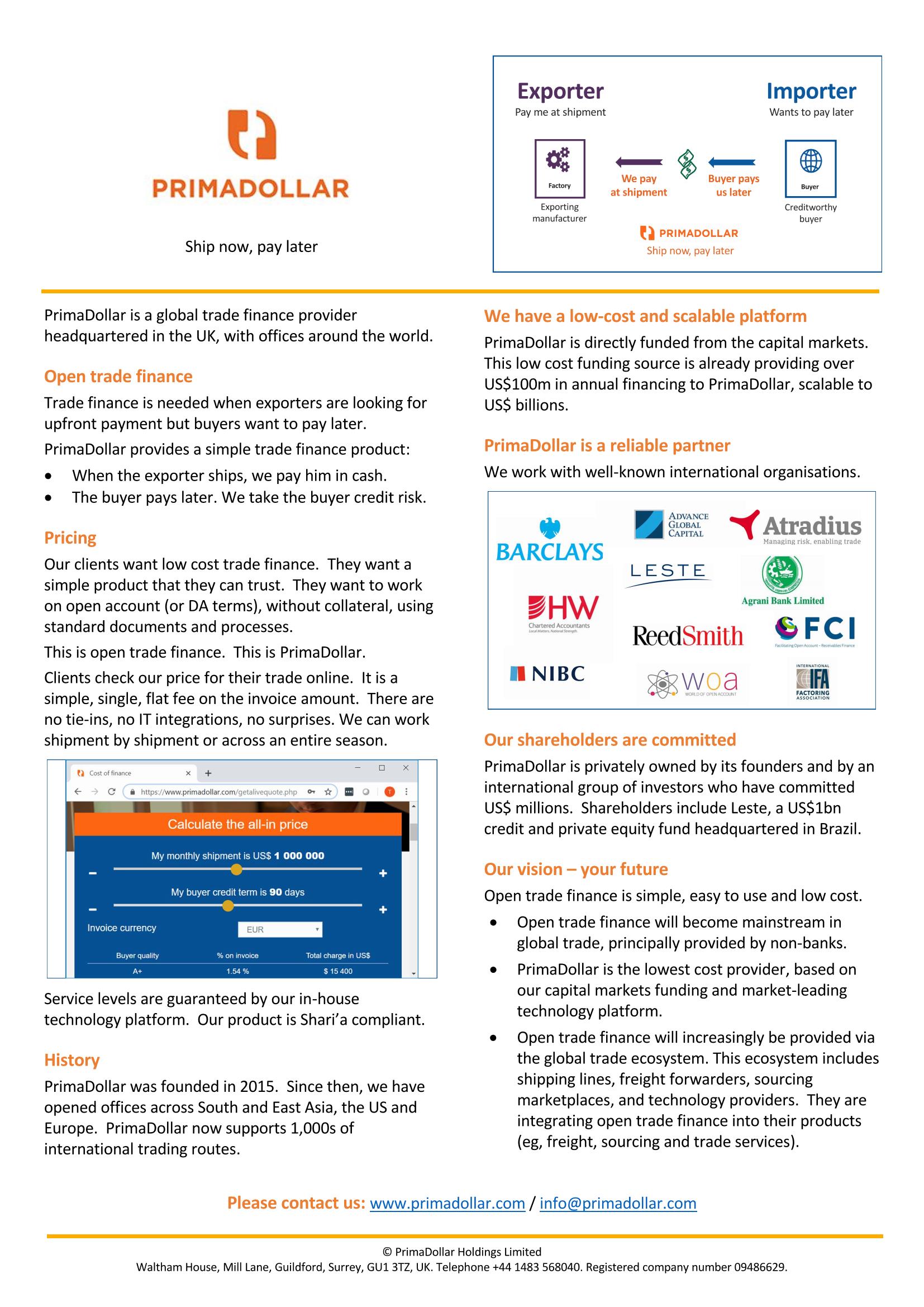

So what kind of checks do we do?

All of this activity is a natural part of our daily business. These are not difficult or complicated matters, and these checks are quick and simple to carry out.

5. So what should you do?

Fraud in international trade has always been present. But with pressure on margins, the move to “open account” or “sale contract” or shipping on “DA terms” – both exporters and their bankers are more and more at risk.

Detecting fraud and managing risk in international trade requires an international network and sophisticated systems to make the checks that are needed.

Use PrimaDollar, and you will have the benefit of our experience, systems and international network. Moreover, our low cost and collateral-free finance pays at shipment – and we take the credit risk of the importer (collecting the funds later from the buyer).

Banks and exporters:

Work with PrimaDollar, and export safely using

our low cost, collateral-free finance.

Check the cost: click here.

Trade finance developments, announcements, new technology and new partners - find out about it by signing up here.

Sign up here