This article was first published on Altfi: here.

PrimaDollar boss Tim Nicolle shares the secret to scaling a start-up.

PrimaDollar is a global trade finance platform that is scaling quickly. A key question from all our stakeholders is: “How are you managing to scale?” How to scale is the major challenge for all start-ups.

The general formula for scaling up

There is a simple formula that explains the scale-up process, “SECA”:

S = (E x C) – A

S is scale

E is enquiry volume

C is conversion rate

A is attrition

What does this formula mean?

We want to grow – that means we want to make scale bigger.

We can do this provided enquiry times conversion is greater than attrition.

Attrition: These are customers that we won previously but which are no longer active or leave the business. Attrition makes the business smaller and is a factor in every start-up. You have to beat the attrition rate to grow.

Enquiry x Conversion: The volume of enquiry is the number of potential customers entering the sales funnel – the number of potential customers coming through your door. The conversion rate is the percentage of this enquiry that you manage to turn into business.

Of course, every business needs to ensure that attrition is minimised and that existing clients are looked after in order to boost their engagement. But these activities generally make a small difference to scale when a business needs to double or treble in size to gain traction with investors.

If we want to scale quickly, either we have to make enquiry bigger or we have to convert more. There are no other ways.

Understanding this relationship is the key first to understanding how to scale, and then second how to scale safely.

General phases of development

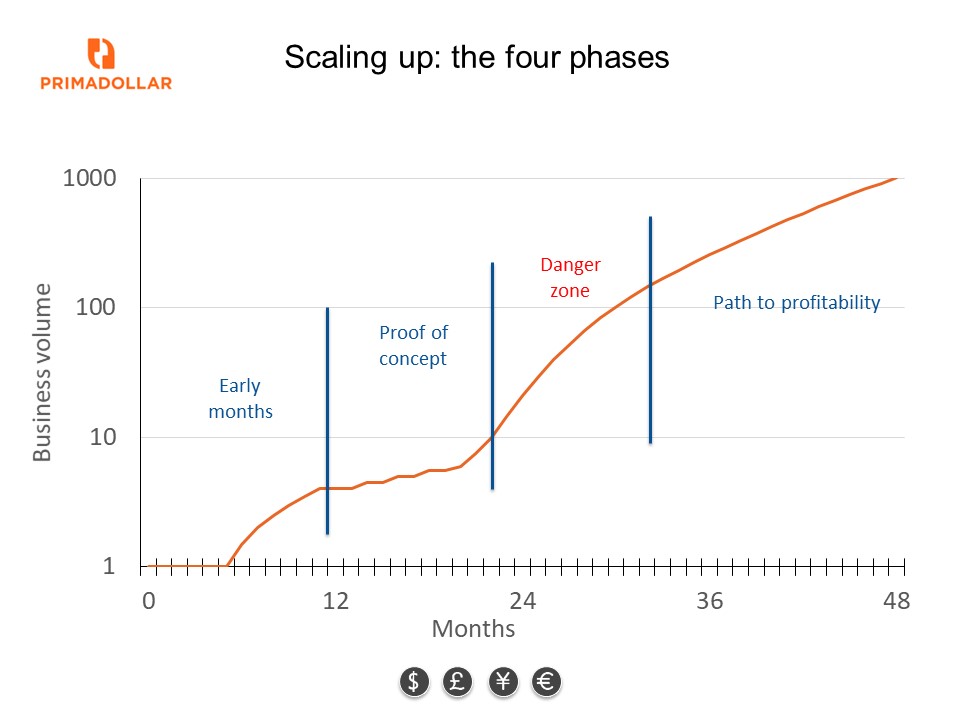

Start-ups go through a four main phases of business development. Moving from one phase to another often involves a “pivot” – a pivot is a usually a change to the business model or change in the mode of operation.

1. The early months: start-up

Address a big market need, at the right price, and in the right way – you have a great opportunity. The early months are spent in price discovery, product design and designing product delivery systems. Where can your product be priced so that people will buy it? What kind of people should want to buy your product? How do you reach these people? How should the product be delivered in practice?

2. Proof of concept

In this phase, enough has been built to go out to the market and trial the products. Ideally some good initial level of business is done, and a number of complete cycles of the product are achieved to validate that customers understand the offer, price points are checked, legal documents work, the path to purchase is clear, and the business works.

3. The danger zone

Moving from proof of concept to initial scale is the most dangerous phase, and where most businesses go wrong. Funds are raised to “scale the business”.

This phase typically involves generating sales momentum in a situation when:

- Probably only a small part of the potential “addressable” market is actually being addressed; you do not have the cash to spend on marketing nor the cash to hire all the people that you really need to do everything 100 per cent.

- Your product is probably not deliverable in fully convenient form as systems are not yet complete; customer service is not automated nor as smooth and online as it should be.

- Your costs are high because you do not have the track record with suppliers to buy in bulk or to demonstrate that risks are predictable.

- Your brand is largely unknown and customer trust is not yet built.

- Your shareholder base is still probably friends and family.

The SECA formula explains what needs to happen. Scale comes from increasing conversion and / or boosting enquiry. There are some business models where increasing conversion is a good way to make progress – for example, in the payments space.

But there are also situations where increasing conversion is dangerous. This is particularly true with credit platforms, which remain at the heart of the alternative finance market. If you are in the credit business, whether this is with your own money or with other people’s money, increasing the conversion rate means taking on business that you might normally turn away. This is a high risk strategy and a dangerous step to take.

The golden rule in credit is to reduce the conversion rate as you expand, and target scale through increasing enquiry.

The danger zone is where many start-ups fail.

4. Path to profitability

Out of the danger zone, and institutional investors are keen to talk.

A business which has moved out of the danger zone looks more like this:

- The business is growing and this growth is driven by enquiry

- The cost of generating enquiry is lower than the value of the customers that are being converted

- The product is priced at its scaled-up level, reducing attrition and adverse selection

- Costs reduce as track record and credibility builds with suppliers

- Stability emerges as the number of clients and markets grows

- Fixed costs become spread over larger volumes of business

The potential for profitability moves into sight.

How do I scale up both quickly and safely?

The SECA formula rules the process.

The best start-ups shorten the danger zone or even step over it completely.

How to do this is explained in part 2 of this article, which will be published on AltFi later this week.